Forex trading, also called foreign trade trading or currency trading, is the world wide market place for getting and offering currencies. It works 24 hours each day, five days per week, letting traders to participate in the market from anywhere in the world. The principal aim of forex trading is to make money from fluctuations in currency trade costs by speculating on whether a currency couple will increase or fall in value. Individuals in the forex market contain banks, financial institutions, corporations, governments, and personal traders.

One of many critical top features of forex trading is their high liquidity, meaning that large volumes of currency can be purchased and distributed without significantly affecting trade rates. This liquidity ensures that traders may enter and leave jobs rapidly, allowing them to take advantage of even little cost movements. Also, the forex industry is highly accessible, with low barriers to entry, enabling persons to begin trading with relatively little levels of capital.

Forex trading supplies a wide variety of currency couples to business, including significant couples such as for example EUR/USD, GBP/USD, and USD/JPY, in addition to modest and amazing pairs. Each currency set represents the change charge between two currencies, with the very first currency in the set being the base currency and the next currency being the offer currency. Traders may profit from both increasing and slipping areas by using extended (buy) or small (sell) positions on currency pairs.

Effective forex trading requires a strong understanding of simple and specialized analysis. Simple evaluation requires analyzing financial signals, such as for instance fascination charges, inflation charges, and GDP growth, to measure the main energy of a country’s economy and their currency. Complex examination, on another give, involves studying price maps and patterns to spot tendencies and possible trading opportunities.

Chance management can be important in forex trading to guard against possible losses. Traders usually use stop-loss purchases to limit their drawback chance and utilize appropriate position size to make sure that no trade may somewhat influence their over all trading capital. Also, sustaining a disciplined trading strategy and managing thoughts such as greed and anxiety are essential for long-term achievement in forex trading.

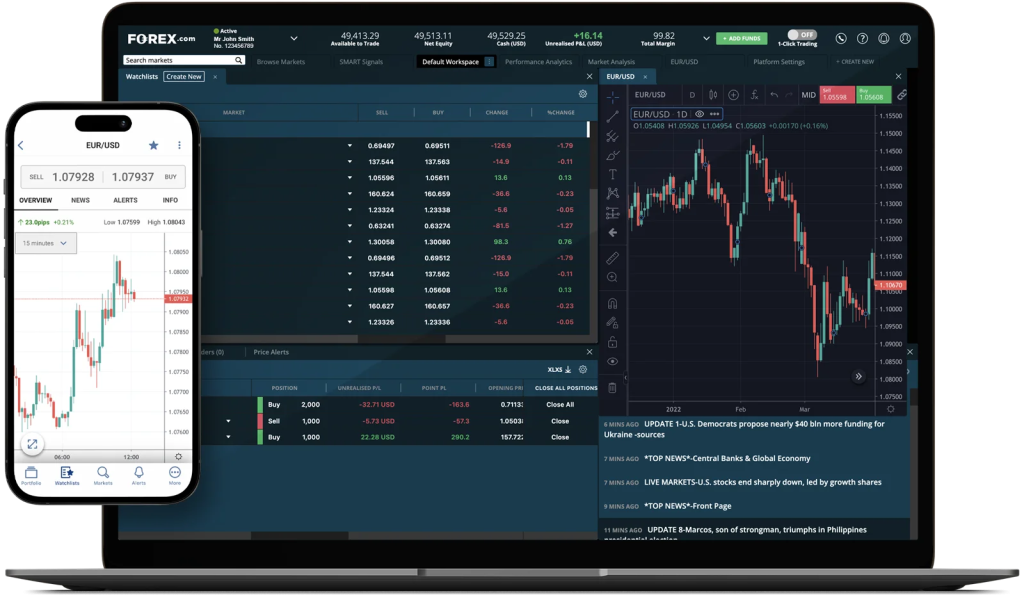

With the advancement of technology, forex trading has be more available than actually before. Online trading systems and portable applications provide traders with real-time access to the forex industry, letting them perform trades, analyze industry data, and control their portfolios from any device. Moreover, the availability of educational forex robot assets, including guides, webinars, and demonstration records, empowers traders to develop their abilities and enhance their trading performance around time.

While forex trading offers significant gain potential, in addition, it carries natural dangers, like the prospect of considerable losses. Thus, it is required for traders to perform complete research, create a noise trading technique, and consistently check market conditions to create knowledgeable trading decisions. By staying with disciplined chance management methods and remaining educated about global economic developments, traders can enhance their likelihood of achievement in the vibrant and ever-evolving forex market.