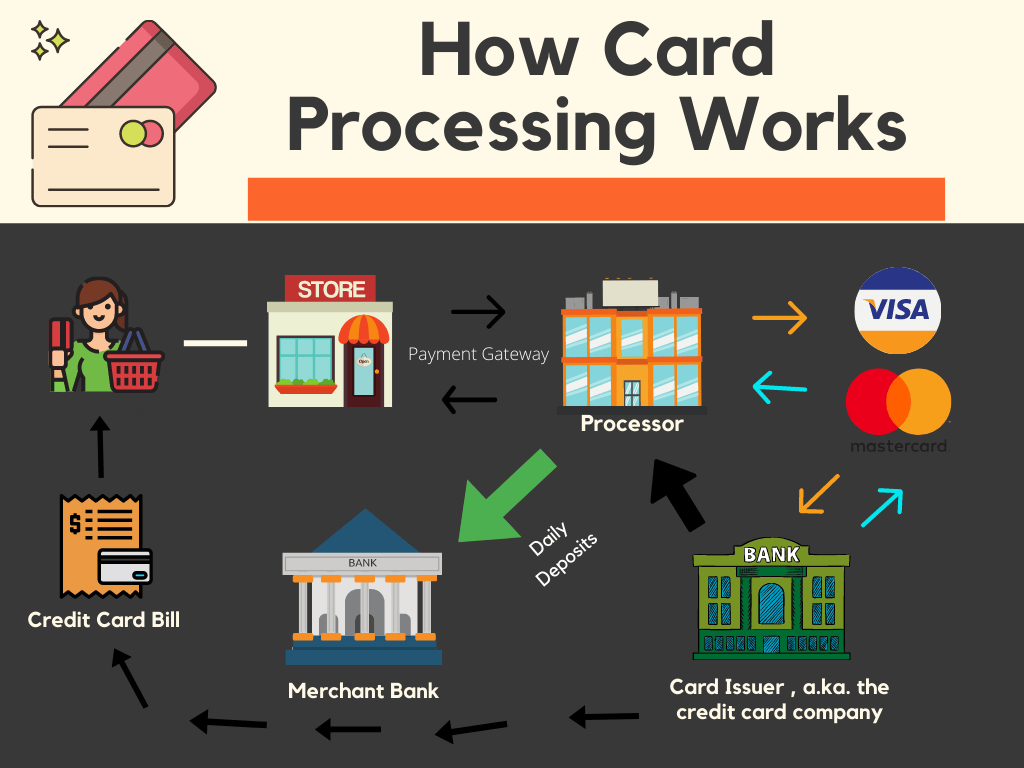

A bank card cost model represents a crucial role in the modern economic landscape, helping whilst the linchpin that facilitates electronic transactions between retailers and customers. These processors become intermediaries, joining companies with the banking process and permitting the smooth transfer of funds. The quality of the purpose lies in translating the information from a credit card transaction right into a language clear by economic institutions, ensuring that funds are certified, refined, and settled efficiently.

Among the primary functions of a charge card payment model is always to boost the performance of transactions. Each time a customer swipes, positions, or sinks their charge card, the payment processor swiftly assesses the transaction details, communicates with the relevant economic institutions, and validates perhaps the purchase may proceed. This method does occur in a subject of seconds, emphasizing the rate and real-time character of charge card cost processing.

Security is just a paramount issue in the world of economic transactions, and bank card cost processors are at the lead of utilizing measures to guard painful and sensitive information. Advanced encryption systems and compliance with business criteria make certain that client data stays protected throughout the cost process. These protection methods not merely safeguard consumers but also impress rely upon corporations adopting digital cost methods.

The credit card cost handling environment is continually changing, with processors establishing to scientific developments and adjusting client preferences. Cellular obligations, contactless transactions, and the integration of electronic wallets signify the lead of development in this domain. Charge card cost processors enjoy a crucial position in enabling corporations to keep forward of these developments, providing the infrastructure required to guide varied payment methods.

Beyond the standard brick-and-mortar retail place, credit card payment processors are crucial in running the great landscape of e-commerce. With the rise of on line searching, processors facilitate transactions in an electronic environment, handling the particulars of card-not-present scenarios. The capacity to seamlessly steer the difficulties of electronic commerce underscores the versatility and usefulness of bank card payment processors.

International commerce relies greatly on bank card payment processors to aid transactions across borders. These processors handle currency conversions, handle international submission demands, and make sure that corporations may operate on a worldwide scale. The interconnectedness of economic systems, reinforced by bank card cost processors, has converted commerce in to a truly borderless endeavor.

Charge card payment processors contribute somewhat to the development and sustainability of small businesses. By offering electric payment options, these processors permit smaller enterprises to grow their client base and contend on an amount enjoying area with bigger counterparts. The accessibility and affordability of credit card payment handling services are becoming critical enablers for entrepreneurial ventures.

The landscape of credit card payment handling also involves criteria of fraud avoidance and regulatory compliance. Cost processors apply robust procedures to find and reduce fraudulent activities, defending both organizations and consumers. Additionally, staying abreast of ever-evolving regulatory requirements assures that transactions abide by legal criteria, reinforcing the become a payment processor and reliability of the payment handling industry.

In summary, bank card payment processors sort the backbone of modern economic transactions, facilitating the smooth flow of resources between organizations and consumers. Their multifaceted role encompasses pace, security, versatility to technical changes, and support for global commerce. As engineering remains to improve and consumer preferences evolve, charge card payment processors can remain key to the energetic landscape of electronic transactions, surrounding the continuing future of commerce worldwide.